zkLend Security Breach: $8.5 Million Theft and a Bold Whitehat Bounty Offer

Hoplon InfoSec

12 Feb, 2025

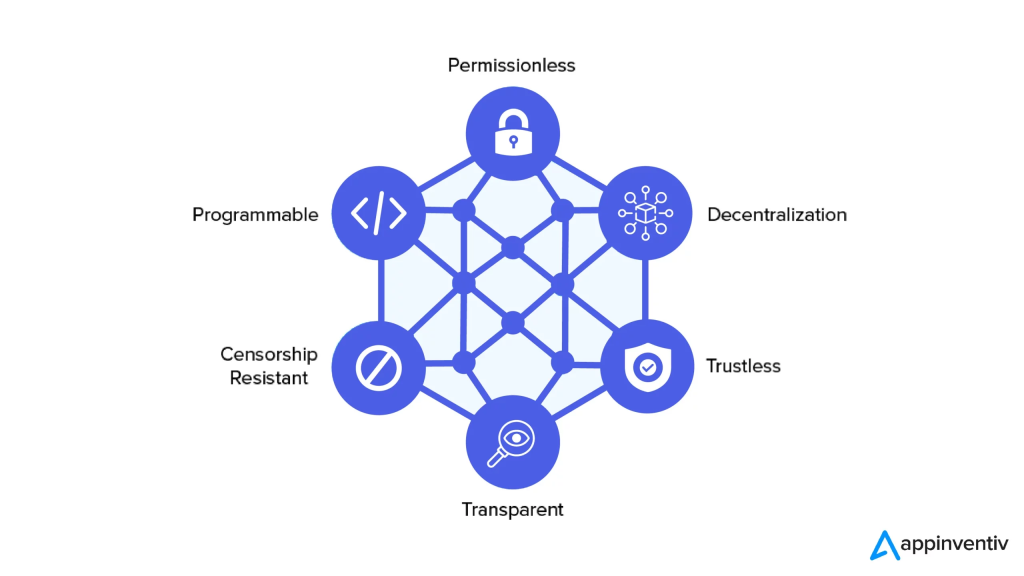

Are you aware of the zkLend Security Breach? Decentralized finance (DeFi) has revolutionized how we interact with financial systems by removing traditional intermediaries and enabling peer-to-peer transactions through blockchain technology. However, as with any emerging field, DeFi has risks. Recently, zkLend—a prominent DeFi protocol built on Ethereum’s Layer-2 roll-up technology—experienced a significant zkLend Security Breach that led to the theft of approximately 3,300 ETH, worth around $8.5 million at current market prices.

In an unusual twist, zkLend has reached out directly to the attacker, offering a 10% white bounty (roughly 330 ETH, or $850,000) if the stolen funds are returned safely. This comprehensive blog post examines the details of the incident, explores the technology behind zkLend, discusses the implications for the DeFi ecosystem, and offers valuable insights for developers, investors, and users.

Introduction to Kind and the DeFi Landscape

Decentralized finance continues to gain momentum as innovative blockchain solutions increasingly challenge traditional financial systems. zkLend has emerged as a notable player in this space by leveraging Ethereum’s Layer-2 scaling solution known as zk-rollups. This technology not only enhances transaction throughput and reduces fees but also aims to preserve the security and decentralization that the Ethereum network is known for.

Despite these advancements, the very nature of DeFi—where code is law—means that even minor vulnerabilities can lead to substantial losses. The recent zkLend Security Breach is a stark reminder of the inherent risks in the rapidly evolving DeFi ecosystem. In this incident, a flaw in one of zkLend’s smart contract functions was exploited, allowing an attacker to withdraw user funds from liquidity pools without authorization. This blog will delve deep into the incident, the response strategy adopted by Kind, and the implications for DeFi security.

The Incident: A Detailed Overview of the zkLend Security Breach

What Happened?

On February 12, 2025, in the early hours of the day, zkLend’s smart contracts—deployed on Ethereum’s zk-rollup Layer-2 network—became the target of a sophisticated exploit. Although the technical details of the vulnerability remain under wraps, early analyses suggest that the breach was due to a flaw in one of the smart contract functions. This flaw allowed the attacker to perform unauthorized withdrawals from the protocol’s liquidity pools.

The attack’s immediate aftermath saw approximately 3,300 ETH being stolen and quickly consolidated into a single wallet controlled by the attacker. The transaction, which has been documented on blockchain explorers like Etherscan via the transaction hash 0xe04a7954d440906344f3f5b4c65b358625af2d393bc88942d6f46636e4080067, has made it possible for independent parties to verify the occurrence of the breach.

The Scope and Impact

The financial impact of this breach cannot be understated. With an estimated loss of $8.5 million, the incident has sent shockwaves throughout the DeFi community. Users who had entrusted their funds to zkLend are now facing uncertainties about the safety of their assets. The incident also raises pressing questions about the security of similar DeFi protocols and the robustness of their underlying smart contracts.

Understanding the Technology Behind kind

Smart Contracts and Their Role

At the heart of DeFi protocols like zkLend are smart contracts—self-executing code that runs on blockchain networks. These contracts are designed to automate complex financial transactions and enforce agreements without the need for intermediaries. The integrity and security of these smart contracts are paramount because any vulnerability can be exploited to devastating effect.

Once deployed, smart contracts are immutable. This immutability is both a strength and a weakness. While it ensures that the contract’s logic cannot be tampered with, it also means that any flaw present in the code remains until a new, corrected version is deployed. In the case of Kind, a subtle error in the contract’s logic allowed an attacker to trigger unauthorized withdrawals, highlighting the need for comprehensive security audits before deployment.

The Advantages and Challenges of zk-Rollups

Zk-rollups represent a significant technological advancement in blockchain scalability. By processing transactions off-chain and then consolidating them into a single on-chain proof, zk-rollups dramatically increase transaction throughput while maintaining high security. This makes them an attractive solution for DeFi platforms that must handle large transactions without high fees.

However, the integration of zk-rollup technology is not without challenges. As the breach illustrates, even the most advanced scaling solutions can harbor vulnerabilities if not implemented and audited correctly. The balance between scalability and security is delicate, and any oversight in clever contract design can compromise the entire system. This incident is a critical learning point for developers and projects leveraging zk-rollup technology.

zkLend’s Response: A Strategic Whitehat Bounty

The Unconventional Approach

In response to the breach, zkLend adopted an unconventional strategy—directly contacting the attacker and offering a white bounty. Whitehat bounty programs are not new to the cybersecurity world. Still, their application in the DeFi space is gaining traction as protocols seek to recover lost funds without resorting to prolonged legal battles. By offering a 10% bounty, equivalent to 330 ETH (approximately $850,000), zkLend is attempting to appeal to the attacker’s ethical side, incentivizing the safe return of the remaining stolen funds.

The Rationale Behind the Bounty

There are several reasons why a whitehat bounty might be seen as a viable strategy:

- Speed of Resolution: Traditional legal proceedings can be time-consuming. By negotiating directly with the attacker, zkLend hopes to recover the funds more quickly, thereby minimizing further damage to the platform and its users.

- Ethical Considerations: The offer leverages the possibility that not all hackers operate purely out of malice. Some might be motivated by the potential to correct their mistakes if presented with a fair and ethical solution.

- Community Trust: Communicating transparently through official channels—including a verified Twitter/X account and the Ethereum ZEND token deployer account—zkLend aims to maintain the trust of its user base by demonstrating its commitment to addressing the breach responsibly.

Potential Risks and Limitations

While the white bounty approach has its merits, it is not without significant risks. One primary concern is that such a strategy might inadvertently encourage other malicious actors to target DeFi platforms, knowing there is a potential for negotiation and a financial incentive for returning stolen funds. Moreover, if the attacker decides not to cooperate or engages in further talks, the situation could escalate, leading to legal and technical complications.

To mitigate these risks, zkLend has set a strict deadline. If no response is received from the attacker by 00:00 UTC on February 14, 2025, the company has promised to escalate the matter by involving law enforcement and blockchain security firms. This dual negotiation approach backed by the threat of legal action underscores the seriousness with which zkLend treats the incident.

Collaboration with Law Enforcement and Forensic Experts

The Role of Blockchain Forensics

In the wake of the breach, zkLend has not solely relied on the white bounty strategy. Recognizing the need for a comprehensive response, the protocol has also engaged with law enforcement agencies and blockchain forensic firms. Blockchain forensics involves using specialized tools and techniques to trace the flow of digital assets across the blockchain. This field has grown rapidly in response to the increasing number of crypto-related crimes, offering a means to track down and identify perpetrators.

By collaborating with experts in blockchain analysis, zkLend aims to monitor the movement of the stolen funds and potentially pinpoint the attacker’s identity. This collaboration is essential for recovering the stolen assets and deterring future attacks by demonstrating that the blockchain is not a haven for criminals.

Legal Implications and Accountability

In addition to technical measures, the breach has significant legal implications. Decentralized finance operates in a regulatory gray area in many jurisdictions, complicating efforts to hold attackers accountable. However, by involving law enforcement and adhering to transparent communication, zkLend sets a precedent for how DeFi platforms can navigate the complex interplay between technology and law. This approach may encourage other projects to adopt similar measures, contributing to a broader culture of accountability and security in the DeFi space.

Broader Implications for the DeFi Ecosystem

Security Vulnerabilities in DeFi

The breach is a stark reminder that vulnerabilities still exist despite the technological advancements and robust security measures implemented by many DeFi protocols. Smart contract bugs, coding errors, and oversights in security audits can create exploitable gaps that attackers are all too willing to exploit. This incident has prompted many in the community to call for stricter standards in innovative contract development and more rigorous, independent audits to prevent similar occurrences.

Impact on User Trust and Market Confidence

Security breaches have far-reaching consequences beyond immediate financial losses. They erode user trust and can affect market confidence in decentralized platforms. For many investors and users, the promise of DeFi lies in its transparency and autonomy. Incidents like the zkLend breach serve as cautionary tales, reminding stakeholders that while the technology is innovative, it is still subject to the same risks as traditional financial systems—if not more so.

Encouraging a Culture of Continuous Improvement

One of the incident’s most essential takeaways is the need for continuous improvement in security protocols. The DeFi community is rapidly learning from each breach, and many projects are now placing greater emphasis on proactive security measures. This includes frequent audits, automated monitoring systems implementation, and cutting-edge security practices such as formal verification of smart contract codes. In the long run, these steps will be crucial in ensuring that the promise of decentralized finance can be realized without compromising the safety of its users.

Lessons Learned for Developers and Security Professionals

The Importance of Rigorous Auditing

For developers working in the DeFi space, the zkLend breach underscores the necessity of comprehensive security audits. Before launching any smart contract, the code must be tested extensively, including simulated attacks and stress testing under various scenarios. Employing independent third-party auditors can help identify vulnerabilities that in-house teams might overlook. Furthermore, continuous monitoring and regular updates are essential as the threat landscape evolves and new exploits are discovered.

Best Practices in Smart Contract Development

In addition to rigorous audits, adopting best practices in coding is vital. Developers should prioritize:

- Code Clarity and Modularity: Writing clear, modular code can help identify and isolate potential vulnerabilities.

- Peer Reviews: Regular reviews can catch subtle bugs that automated tools might miss.

- Implementation of Fail-safes: Incorporating mechanisms that allow for rapid response—such as pausing transactions or reverting malicious actions—can limit the damage if a breach occurs.

Building a Collaborative Security Culture

The DeFi ecosystem is still in its infancy, and its challenges are best addressed through collaboration. Developers, security researchers, and users should collaborate to share insights and develop industry-wide security standards. Programs encouraging ethical hacking and responsible disclosure can help uncover vulnerabilities before exploitation. While not a panacea, the white bounty approach is one example of how the community can foster a culture of collaborative security.

Practical Advice for Investors and Users

Conducting Due Diligence

For investors and users, the zkLend breach reminds them of the risks inherent in the DeFi landscape. It is crucial to conduct thorough due diligence before engaging with any platform. Look for projects with a solid track record regarding security, transparency, and responsiveness to issues. Platforms that have undergone multiple independent audits and maintain open communication channels with their user base are generally more reliable.

Diversifying Investments

A key strategy for mitigating risk in the volatile world of DeFi is diversification. By spreading investments across multiple platforms, users can reduce the potential impact of a single breach. While diversification does not eliminate risk, it can help safeguard your assets from the fallout of any one security incident.

Staying Informed

The rapidly evolving nature of DeFi means that staying informed is more important than ever. Follow trusted news sources, join community forums, and engage with experts to keep up with the latest developments in blockchain security. Awareness of common vulnerabilities and emerging threats can help users make more informed decisions about where to invest their time and money.

The Future of Security in Decentralized Finance

Embracing Advanced Monitoring Technologies

Looking ahead, the future of DeFi security lies in the adoption of advanced monitoring and response technologies. The integration of artificial intelligence and machine learning in blockchain monitoring is already showing promise in detecting unusual patterns and flagging potential breaches in real time. These technologies can analyze vast amounts of transaction data, providing early warning signals that enable rapid intervention before a breach escalates into a significant incident.

Establishing Industry-Wide Standards

Another critical step in bolstering DeFi security is establishing industry-wide standards for innovative contract development and auditing. Regulatory bodies, industry associations, and leading DeFi projects can collaborate to create guidelines that set a high bar for security practices. Such standards would protect individual platforms and enhance the decentralized finance ecosystem’s overall credibility and stability.

Fostering a Proactive Security Mindset

Ultimately, the continued growth and success of DeFi depend on a proactive approach to security. This means reacting to incidents after they occur and anticipating potential vulnerabilities before they can be exploited. As the community learns from incidents like the zkLend breach, a proactive security mindset—characterized by continuous improvement, collaboration, and innovation—will be essential in building a resilient and trustworthy financial system.

Conclusion

The zkLend Security Breach in Kind, which resulted in the theft of approximately 3,300 ETH (valued at around $8.5 million), is a stark reminder of decentralized finance’s promise and the perils. While the incident has undoubtedly shaken confidence, it has also provided valuable lessons for developers, investors, and users. zkLend’s decision to offer a white bounty reflects an innovative approach to crisis management that prioritizes rapid recovery and ethical resolution over immediate confrontation.

For developers, the incident highlights the importance of rigorous audits, best coding practices, and the need for a collaborative approach to security. For users and investors, it underscores the necessity of due diligence, diversification, and staying informed about the risks associated with DeFi platforms. And for the broader DeFi community, it catalyzes renewed focus on building more secure, resilient systems that can withstand the challenges of an ever-evolving digital landscape.

In the wake of the breach, the path forward involves a multifaceted approach: integrating advanced monitoring technologies, establishing industry-wide security standards, and fostering a proactive security culture. By learning from the lessons of the past and embracing innovation in security practices, the DeFi ecosystem can continue to grow and thrive while ensuring the safety and trust of its users.

As we look to the future, incidents like the zkLend breach will undoubtedly shape the evolution of decentralized finance. With every challenge comes the opportunity to strengthen the foundations of this transformative technology. The journey toward a secure and robust DeFi environment is ongoing, and the collective efforts of developers, investors, security professionals, and regulators will be key to unlocking decentralized finance’s full potential without compromising security.

In summary, the incident is not merely a story of loss and vulnerability; it is a call to action for the community to prioritize security, embrace collaboration, and continuously innovate. Only through these concerted efforts can the promise of DeFi be fully realized, paving the way for a future where decentralized financial systems are as secure as they are revolutionary.

By taking proactive steps today, we can help ensure that tomorrow’s DeFi platforms are better equipped to handle the challenges of an ever-evolving threat landscape. Whether you are a developer fine-tuning smart contract code, an investor researching the safest platforms, or simply an enthusiast eager to learn more about this dynamic field, the lessons from the zkLend breach serve as a vital reminder: in the world of decentralized finance, security is paramount, and continuous improvement is the key to sustainable growth.

Stay informed and vigilant, and together, we can build a safer, more resilient DeFi ecosystem for everyone.

Share this :