FBI Reports 262M in ATO Fraud: Shocking 2025 Scam Alert

-20251126101645.webp&w=3840&q=75)

Hoplon InfoSec

26 Nov, 2025

FBI: $262M in ATO Fraud as AI Phishing and Holiday Scams Rise

When the FBI says there are 262 million dollars in ATO fraud, it's not just a number. It is a very loud wake-up call. A lot of people think of cybercrime as something far away or technical, but the truth is much closer. Today's attacks are well-planned, tailored to the target, and disturbingly human. Criminals now use artificial intelligence and social manipulation together to make simple scams into very successful takeovers.

The fact that the FBI reports 262M in ATO fraud also suggests a bigger change. At first, these attacks were just people trying to guess passwords. Cybercriminals now act more like spies. They look at the victims, copy their writing styles, make fake login pages that are perfect, and get personal information. They take over everything in an account without making a sound, and sometimes they don't even leave a single clue.

Understanding the Growing Problem of Modern Cybercrime

What ATO Fraud Really Is

When someone gets into your online account and uses it like it's their own, that's called account takeover fraud. It could be a bank account, an email account, or even a loyalty card for a grocery store. When the FBI says there are 262 million cases of ATO fraud, it means that criminals used stolen identities to steal money, make purchases, or lock people out.

The fact that the attack can be so quiet makes it even more dangerous. A lot of victims don't realize something is wrong until days later. By that time, criminals may have changed the recovery emails, changed the passwords, or emptied the digital wallets. The phrase "FBI Reports 262M in ATO Fraud" tells us how much money was lost, but it's harder to measure how it affected people emotionally.

The most recent FBI report provides us more information about technical threats.

The most recent FBI update gives a clearer and more frightening picture than earlier reports did. The agency also said that more than 5,100 people and businesses have officially reported incidents this year, which suggests that there is a much bigger problem that isn't being talked about. The report also shows how much more complicated and clever today's scams are.

Criminals are not only pretending to be bank tellers, support staff, or even police officers; they are also using methods like SEO poisoning to make fake financial websites show up at the top of search results. Once money is taken, it is quickly moved through many accounts and turned into cryptocurrency, which is very hard to track.

Cybersecurity companies added even more worrying information: hundreds of malicious holiday-themed domains, a sharp rise in mobile phishing, QR code scams, and attackers taking advantage of new weaknesses in well-known e-commerce sites. These results show that the threat landscape is changing very quickly and is much more complex than what earlier summaries showed.

Why the Number Scares Experts

Researchers who study security know patterns, and one thing bothers them. The number keeps going up. The FBI's report of 262 million dollars in ATO fraud this year shows that criminals have found a way to make money. And right now, artificial intelligence is working for them. It helps them send phishing emails that look real, make up fake identities, and launch attacks on a scale we've never seen before.

How criminals are using AI to make attacks stronger

Phishing Engines That Use AI

It used to be easy to spot phishing emails. They were easy to spot because of their bad grammar, strange formatting, and strange requests. But now, AI tools can write emails that sound real. They sound like emails from your bank or job. A lot of researchers think this is one of the main reasons why the FBI is seeing more and more cases of ATO fraud.

These AI engines can even change messages based on how the victim acts on social media. They learn how to write common phrases or things they like. People let their guard down when an attack seems personal.

Voice Spoofing and Clone Websites

AI models can now make whole fake websites. The clone will look almost exactly like your bank's layout if it is clean, white, and blue. Think about clicking on a link that looks familiar, typing in your login information without thinking, and giving up your login information without even knowing it.

Another problem is voice cloning. Some attacks use AI to make voices of family members asking for money in an emergency. These methods show how smart criminals have become in a world where the FBI says there are 262 million ATO fraud cases.

Scams during the holidays are at an all-time high.

Deals on fake shopping

During the holidays, there are a lot of sales and deals. Cybercriminals blend in with the noise. They make fake discount sites, sell fake goods, and get people's credit card information. When victims later report losses, their cases are included in the FBI's $262M report on ATO fraud.

Gift Card Scams

Scammers like gift cards because they can't be traced. Many victims get emails saying they won a prize or need to pay for a service renewal. The directions seem important. People often act quickly without checking details when they're stressed out during the holidays.

Scams that say you got a delivery

Criminals also pretend to be well-known shipping companies. Fake tracking messages lead to pages that steal your account information. All of this adds to the problem that the FBI reports 262 million dollars in ATO fraud.

Why ATO Fraud Is on the Rise

Bad Password Habits

People use the same password on many different sites. One breach can open everything. This is something attackers know. So they test passwords across major platforms using leaked databases.

Data Leaks Attacks on Fuel

Every breach makes more data available. Criminals get bits of information from all over the place. Then they use AI tools to put it all together into neat profiles of the victims. The FBI says that 262 million dollars in ATO fraud is often caused by these planned attacks.

Tricks for Social Engineering

Attackers take advantage of how people are. We want to help. Messages that sound familiar are more likely to be true. We do what needs to be done right away. Criminals can take over accounts without hacking anything technical by taking advantage of these instincts. This is a big part of why the FBI says there were 262 million ATO fraud cases this year.

A Close Look at the FBI Report

How the FBI Figures Out ATO Fraud

The numbers come from complaints that have been checked out, reports from banks and other financial institutions, and investigations that involve more than one agency. The FBI says there is $262 million in ATO fraud, but the real number could be much higher because a lot of people don't report small losses.

Emotional and financial damage

A lot of victims say that the emotional damage hurts more than the financial loss. If you lose access to an email account, you lose years of pictures and conversations. Some victims feel ashamed or hurt. The phrase "FBI Reports 262M in ATO Fraud" hides these stories.

Victims' Stories from the Real World

Taking over online banking

One victim said she woke up to find several transfers that she hadn't approved. The money was gone by the time she called the bank. Attackers had changed her recovery information, which completely locked her out.

Lockdowns on e-commerce accounts

Another victim had his shopping account taken over. Attackers ordered a lot of things, changed their addresses, and used saved credit cards. When the FBI reports 262 million dollars in ATO fraud, this is the kind of thing that makes the number go up.

Researchers in security sound the alarm.

Machine Learning in the Hands of Criminals

Researchers say that criminals are using AI like a business tool. They do everything automatically. They try out thousands of different kinds of phishing. They change faster than old defenses can keep up.

Hard to find, but spreads quickly.

AI phishing emails often look better than emails from real businesses. Some workers fall for them right away. The FBI says that this speed is one of the reasons for 262 million dollars in ATO fraud.

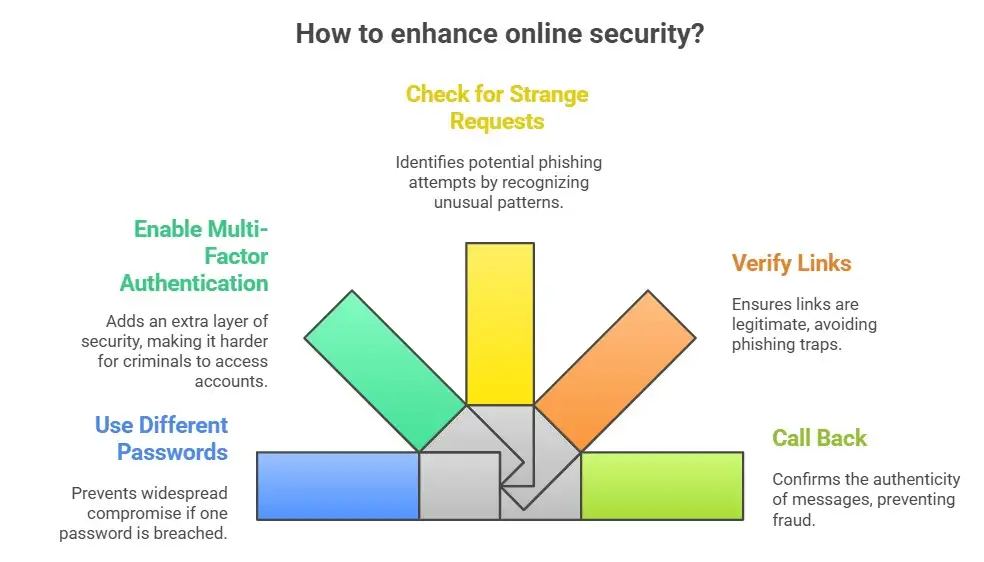

How to Keep Yourself Safe as a Consumer: Make Your Login More Secure

Make sure you use different passwords for each site. Turn on multi-factor authentication whenever you can. These little things can ruin a criminal's whole plan.

Find AI Phishing

Check for strange requests or a tone you don't know. Put your mouse over links. Make sure messages are real by calling them back. These habits lower the chances that you will be one of the 262 million people who are victims of ATO fraud, according to the FBI.

How Businesses Should React

More layers of authentication

Companies should use more than just passwords for their multi-step login checks.

Models of Zero Trust

You should be suspicious of every login attempt until you can be sure it's real.

Will AI Make Fraud More Common in the Future?

A lot of experts think that criminals will keep getting better at what they do. But better security tools, more awareness, and stronger authentication can lower risk. The FBI's report of 262 million dollars in ATO fraud makes one thing clear. Cyber defense needs to change quickly.

To sum up,

The news that th FBI reports 262 million dollars in ATO fraud shows how far cybercrime has spread. Attackers are still going strong with AI tools, holiday scams, and smart social tricks. People can spot and avoid these scams if they know how they work. Criminals have a harder time getting away with things when we know more. Being aware, being ready, and having good security habits will always be our best defense.

Questions and Answers

Why is the FBI's report of 262 million dollars in ATO fraud important?

It shows how common account takeover attacks have become and how criminals now use more advanced tools.

2. How does AI make fraud more likely?

AI helps hackers make better phishing emails, fake voices, and fake websites.

3. How can people avoid fraud with ATO?

Use strong passwords, turn on multi-factor authentication, and check messages that look suspicious.

4. Are businesses also being targeted?

Yes, businesses are at a lot of risk from attacks on their supply chains and employees' accounts.

Share this :