Things Users and Developers Should Know About Google's Crypto Wallet Rules

Hoplon InfoSec

14 Aug, 2025

Why the Google Play crypto wallet license requirements 15 regions Matter

As an independent developer, you’ve been working on a new bitcoin wallet app for months. You finally put it on Google Play, and now you’re happy that you can talk to folks from all over the world. A few months later, Google sends you an email indicating that your app will be taken down if you don’t get some money licenses in a few countries. The Google Play crypto wallet license only works in 15 places, which makes it hard for developers.

These new guidelines are changing the way millions of people use wallet apps and the way they are produced. It used to be easy to develop wallet software, but today there are a lot of restrictions and legal difficulties that make it complex. This could mean that Android users don’t have as many choices when it comes to wallets. Developers will have to choose between paying for costly licensing or not being able to enter certain markets.

Setting the Scene: What Made the Policy Change

In August 2025, Google claimed that some countries need their governments’ approval to use custodial crypto wallet apps. This was the right first step. The company maintains the users’ money and private keys safe in a custodial wallet. That means the business has to do what the rules say concerning money. Countries and governments were exerting more and more pressure on Google to deter people from using digital assets to commit fraud and money laundering.

At first, it wasn’t obvious if these regulations also applied to wallets that didn’t have any money in them. Several developers were concerned that wallets that allow users keep their own keys would also need a license. A lot of people in the crypto field were worried about how vague this was. Some developers even considered about taking their apps down early so they wouldn’t get in problems with the law.

Scope and Scale: There Are at Least 15 Areas That Are Affected

Fifteen places will have to follow Google’s regulations for crypto wallets. The US, the EU, Canada, Hong Kong, Japan, South Korea, Thailand, Switzerland, the UAE, Israel, Bahrain, the Philippines, and South Africa are all taking part. There are rules around money in all of these markets.

Developers must follow the rules in these countries to receive a license to run a custodial wallet program. That may mean that every place has its own rules, which would be hard to follow and take a long time. A lot of small firms that wish to grow their business around the world find this very hard.

FinCEN Guidance for U.S. Developers

FinCEN, the Financial Crimes Enforcement Network, now advises that US custodial wallet providers must register as either a money services business or a money transmitter. Signing up isn’t just a formality. It has to be able to stop money laundering, apply know-your-customer standards to check the identities of its customers, and tell the authorities about any suspicious behavior that happens.

This means that U.S. developers can’t just put a custodial wallet on Google Play without first following these requirements. Over the past ten years, the country’s way of keeping track of money has been employed more and more for digital assets.

EU Regulations for Crypto Enterprises

The EU follows the MiCA guidelines for crypto-assets. MiCA claims that anyone who builds custodial wallets must register with their country’s financial authority as a Crypto-Asset Service Provider (CASP). The company has to fill out a lot of paperwork to show that it follows the rules, has solid cybersecurity, and has clear means to keep consumers’ money safe.

France and Germany have transitional timetables that let developers get adjusted to the new rules. Germany has till December 2025 and France has until June 2026 to completely comply. Even though the deadlines have been moved back, developers still need to finish their licensing applications as soon as they can. This is to make sure that services stay running.

Licensing in Canada, Hong Kong, Japan, and Other Regions

The U.S. and the EU are the only two countries on the list that have the same rules for receiving a license. In Canada, custodial wallet providers must register with the Financial Transactions and Reports Analysis Center of Canada (FINTRAC). The Hong Kong Securities and Futures Commission needs to get some permits.

According to the Financial Services Agency of Japan, custodial wallet providers should be viewed as regulated services for trading cryptocurrencies. In South Korea, you have to sign up to be a Virtual Asset Service Provider. In the UAE, Israel, Bahrain, the Philippines, Switzerland, and South Africa, there are groups that grant out financial licenses. It’s challenging for global wallet providers to follow the standards because they need to know a lot about the legislation.

Timeline: Developers Need to Keep Critical Dates in Mind

On October 29, 2025, these restrictions will start to apply to fifteen places that want to license Google Play crypto wallets. By this date, all developers must have the licenses they need to work wherever they desire. The app will probably be taken down from the Google Play Store in those countries if you don’t follow the regulations.

Some countries have moved their deadlines back, but that doesn’t imply developers can wait to start. It could take a long time to get a license, maybe even more than a year, especially if you have to do background checks, financial audits, and fill out documents to show that you are following the requirements.

Custodial vs Non-Custodial Wallets

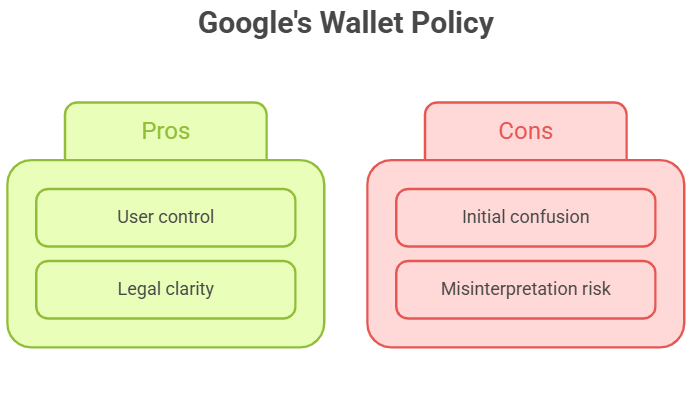

One of the best things about Google’s new policy is that wallets that don’t retain your money don’t have to meet the same conditions to receive a license. Users can retain their private keys in a non-custodial wallet, which means that the app author can’t get to their money. This difference is incredibly essential since it lets us know what is and isn’t legal.

At first, when Google talked about the policy, it wasn’t apparent that it didn’t apply to wallets that weren’t custodial. A lot of independent developers and open-source wallet projects were scared that they may be taken off the Play Store, even if they didn’t have any customers’ money.

How Google Provides Guidance to Developers

Google announced in a public statement that the new licensing restrictions don’t apply to wallets that aren’t custodial after hearing what others in the crypto business had to say. A number of developers that produce open-source wallets that other people can use liked this version a lot.

But the event revealed how rapidly changes in the legislation can make the market less stable. It also made it plain how crucial it is for major businesses to be honest when they engage with industries that regulators are already keeping a close eye on.

The Developer Dilemma: Cost vs Market Access

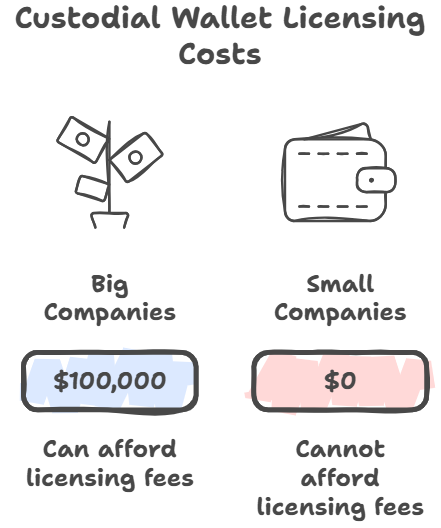

Now, people who make custodial wallets have to choose between paying a lot of money for a license or not being able to sell in huge markets. Getting licenses can cost hundreds of thousands of dollars in application costs, legal fees, and regular payments to be in compliance. Small firms can’t always do this because they don’t have the money.

Companies like Coinbase and Binance that are bigger can pay these fees more readily. The new rule might favor bigger enterprises by mistake because they don’t have enough money. This would make it hard for people to find small businesses on the app store.

Concerns About Centralization in Crypto

People who are interested in bitcoin are worried about decentralization, but new licensing restrictions could make the business go in the opposite direction. If only huge, well-funded enterprises can receive a Google Play crypto wallet license in 15 regions, smaller businesses may have to quit doing business.

This could mean that there are fewer types of wallets and wallets to pick from in the long term. Some people are apprehensive that the fact that a few huge businesses own most of the services goes against the crypto industry’s aims of being fair and open.

User Experience: Wallets That Don’t Work on Android

Because of these changes, some people might not be able to use some wallets on Google Play anymore. You don’t need a license to own a wallet, and you don’t have to keep it safe. But if the rules are too severe, it can still be closed.

People might hunt for wallets in places other than the app shops that are approved. This would make it more probable that they would get malware or other dangerous software. People will have to be extra careful and pay more attention when they go to this new site.

Alternative Ways to Get Apps on Your Phone

If developers don’t want to or can’t follow the rules of the license, they could find alternative means to get their work seen. One way that firms may achieve this is by letting users download APKs straight from their own websites. You can also put their apps in other app stores, such the F-Droid or the Amazon Appstore.

The software works now that these adjustments have been made, but it is not as easy to use. Google Play doesn’t check for security, so users have to apply updates by hand. This lets malware move around in ways that aren’t allowed more easily.

Balancing Compliance and Innovation

It’s challenging to establish a nice balance between following the rules and making new things. Governments want to prohibit people from being deceived and laundering money, but developers want to be able to design new financial tools without having to obey too many rules.

There are 15 different rules that Google Play crypto wallets must observe. This indicates that rules for platforms can have an effect. This guideline is supposed to protect customers, but if it isn’t applied in a flexible way, it could slow down the speed of technological innovation.

Accessing Crypto on Your Phone: What Users Should Know

The market for Android crypto wallets will shift a lot as the October 2025 deadline approaches near. There may be fewer custodial wallets in the Play Store, but developers of non-custodial wallets may gain more attention because they don’t have to follow the same rules.

These rules might help some new ideas get to the web or other places throughout time. The main challenge is if security and compliance can handle the openness and competition that have enabled digital assets expand.

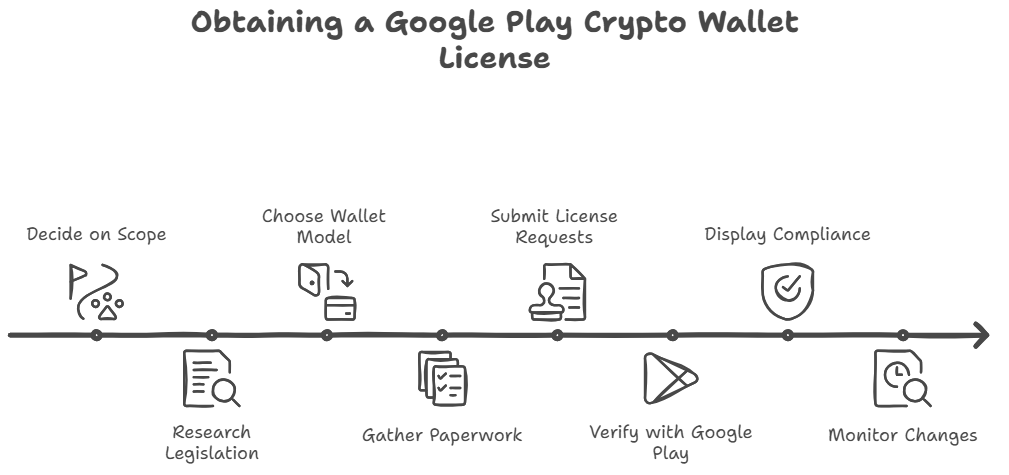

Places to Find a Google Play Crypto Wallet License

It can be hard to get a license for some things, but understanding what to do can help. This is an excellent approach for folks who make custodial wallets to learn how to obey the regulations.

Step 1: Decide what you want to do. List all the countries where you want your custodial wallet to work. To receive a Google Play crypto wallet license, you need to have at least 15 venues that are regulated.

Step 2: Learn about the legislation in your area. Find out exactly what you need to do to receive a license in the country you wish to go to.

Step 3: Pick a model that does or doesn’t have a custodian.

Step 4: Check that you have all the paperwork you need.

Step 5: Send in your requests for licenses.

Step 6: Use your Google Play Developer Account to verify.

Step 7: Make compliance visible to users.

Step 8: Monitor regulatory changes.

This workflow helps developers meet the requirements while staying in the Play Store.

Last Thoughts

Google wants to be able to use crypto wallets in 15 cities. This is a step toward making online banking safer and easier to use. It makes people feel better about it, but the people who make it have to work harder. This means that consumers are less likely to fall for scams or download programs that are not safe. This could make the world of bitcoin safer in the long run by persuading more people to obey the same rules.

Follow us on X (Twitter) and LinkedIn for more cybersecurity news and updates. Stay connected on YouTube, Facebook, and Instagram as well. At Hoplon Infosec, we’re committed to securing your digital world.

Share this :