UK Bitcoin Seizure Exposes Massive £5.5B Hidden Crypto Fortune

Hoplon InfoSec

30 Sep, 2025

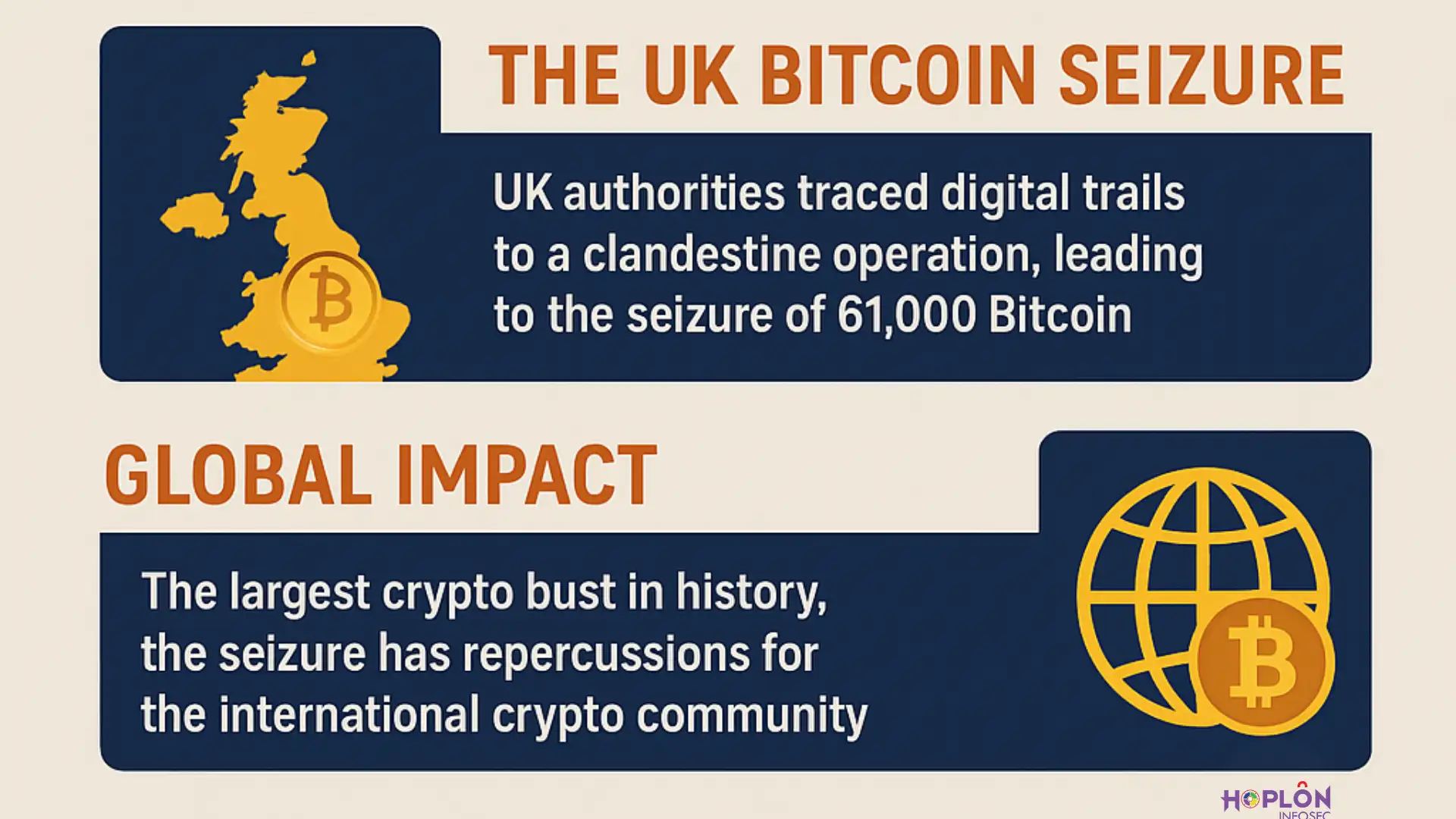

Everyone stopped scrolling for a second when they heard that the UK police had taken £5.5 billion in Bitcoin. There was more to this than just another money headline. The amount was so large that it made you sit up and pay attention. That amount is more than what a few small countries spend in a year, just so you know.

The UK's seizure of Bitcoin, which happened a while ago, is now the biggest crypto bust in history. There is more to the story than just the numbers. It has to do with people's greed, lying, watching the world, and the strange double life of cryptocurrencies.

It all started with a promise to make thousands of regular people rich quickly, but it ended up in a London court. The ending of the story is full of crime novel twists, but the people who died were real.

The Rise of a Smart Plan Behind the UK Bitcoin Seizure

China made a detailed plan from 2014 to 2017. Some investors were promised big profits and told they could make three times as much money in just a few months. A woman who called herself a "crypto success story" was the first to make this dream come true. Many people thought she was a visionary who had figured out how to make money on the internet.

But the pretty picture was just a scam. More than 100,000 people gave money, and many of them were regular people, retirees, and families looking for safety. A lot of the money went into Bitcoin wallets instead of real investments. That choice led to a chain of events that ended with the shocking UK Bitcoin seizure.

Detectives Follow a Digital Trail

In 2018, British police heard rumors about strange business deals. Detectives from the Metropolitan Police Economic Crime Command were sent to look into it. Bitcoin leaves digital traces on the blockchain, but cash can disappear right away. All transactions and interactions with a wallet are kept on file.

They used forensic tools, got bank and property records through subpoenas, and slowly put all the pieces of the puzzle together. It was work that needed to be done carefully. The raid on a mansion in Hampstead was the most important thing that happened. They found things that kept wallet keys. You could suddenly get thousands of coins. That breakthrough led to the UK Bitcoin seizure.

The Bust That Made History

So what did they really take? They stole an incredible 61,000 Bitcoin. That comes to about £5.5 billion at today's prices. This is the biggest seizure of digital money ever. It's hard to say how big it is. One of those wallets had more money in it than a whole company's bank account.

The case showed something very important. It may seem impossible to touch digital currencies, but law enforcement can still lock them down if they keep trying and know how to do it. A lot of people in the crypto world woke up when the UK seized Bitcoin. It was not true that people could be completely anonymous.

Zhimin Qian The Woman Who Built the Empire

The woman who built the empire and is at the center of this storm is Zhimin Qian, also known as Yadi Zhang. She called herself a "crypto queen" and bragged about her money while telling other people she could help them make a lot of money.

There was a criminal hiding behind the confident front who was on the run from the law in China. Qian got to the UK in 2017 with fake papers. To fit in with the rich people in London, she lived in nice homes for a while.

She seemed untouchable, moving with the kind of quiet pride that comes before a fall. But her carefully built empire wasn't built on blockchain genius. It was based on lies, and in the end, those lies caught up with her.

People Who Lost It All

Sometimes, numbers can make people seem less important. About 128,000 people are behind the billions. A lot of people put money they needed for college,

retirement, or loans they couldn't afford to lose into the market. Friends or neighbors talked some people into it, and they became interested.

Some people signed up because they thought the plan would work where they lived. When the truth came out, the damage was awful. People who had worked hard to save money lost it all in one night.

Crushing debt took the place of dreams of safety. The UK Bitcoin seizure is so bad because of the people who lost money. It's not just about coins on a blockchain; it's about trust being broken and lives being ruined.

The Network for Money Laundering

Someone helped Qian with the laundry. Jian Wen was one of the most important people who helped clean up the crypto fortune. She used parts of Bitcoin to make jewelry, money, and property in London. These things did not happen by accident. They were well-planned attempts to make money that was dirty look clean.

Wen was found guilty in 2024 and given a sentence of more than six years in prison. Her case showed how people in the real world often mix their crypto wealth with their real wealth.

The UK Bitcoin seizure broke down those walls and showed how quickly illegal money can move from digital wallets to high-end markets.

Digital wallets and the false sense of privacy

People want to know more about this story because they think Bitcoin is hard to find. No, it isn't. The blockchain keeps track of every transaction. Wallet addresses may look private, but if you know enough, you can see patterns.

Using clustering, exchange records, and forensic software, police can figure out who owns something. The police made it easier to figure out the puzzle when they found Qian's hardware. The UK government's seizure of Bitcoin shows how easy it is to lose your private keys.

There are many accounts where you can hide money, but if investigators find one device that holds the keys, the whole thing falls apart.

Working together across borders

The UK didn't do this investigation alone. Chinese and British officials worked together closely, with the Chinese giving the British tips and proof. This level of fraud is too much for one area to handle. Agencies need to work together across borders, even when politics are tense.

The fact that someone stole Bitcoin shows how important it is for people from different countries to work together. The case might have stopped if China hadn't given them any information.

And it was important for the UK legal system to stop the money from moving. In the future, this kind of cooperation might become normal for crypto investigations.

Legal Frameworks Under Pressure

The seizure also shows that the law is trying to get up to speed. The UK used the Proceeds of Crime Act, which was written before Bitcoin was even invented. Prosecutors had to change the way they defined property to include digital assets.

Defense lawyers tried to say that Bitcoin wasn't real money, so the same rules about taking it away didn't apply. The court finally agreed with the prosecutors, but the case shows that things aren't always clear.

People remember the UK Bitcoin seizure for how big it was and the trouble it caused with the law. People are now telling lawmakers to make rules that are easier to understand in the digital age.

What Happens to the Money Now

It makes things worse to take a billion pounds. Who gets the cash? The UK government could sell some of its Bitcoin and use the money to pay for things like schools and roads. People in China who were hurt are asking for money. Lawyers are already circling, getting ready to file civil cases to get their share.

It's not easy to keep track of all this digital money. It's hard to keep wallets safe, stop hackers, and figure out how to sell without crashing the market. It's just as hard to figure out how to win in court as it is to figure out how the UK took bitcoins.

Problems with diplomacy

The issue of who owns what has already caused trouble. China says that the money should go to Chinese people who were wronged. The UK has its own legal claims. Neither side wants to lose billions of dollars easily.

It seems that diplomats will talk things over in private, but this fight shows how digital crime can hurt countries all over the world. The UK taking Bitcoin is now a legal issue and a move in international relations.

What criminals and regulators can learn

Criminals should know that crypto is not a safe place to hide. Even the biggest amounts of money can be found, taken, and charged by investigators. The case shows that regulators need to keep a closer eye on things, work with other countries, and spend more money on forensic tools.

The UK Bitcoin seizure is a sign. It lets people who want to commit fraud know that they are not out of reach. And it lets people and investors know that governments are slowly getting better at fighting back in the digital financial world.

Effect on rules for cryptocurrencies

The seizure might make it easier for countries to change how they regulate crypto. Exchanges will have to follow stricter rules, check people's identities, and keep an eye on big transactions. Countries might even want global standards to make sure that no one area is safe.

The UK Bitcoin seizure is now a case study. People will use it for meetings, policy talks, and school papers. For years to come, its effects could change how people use cryptocurrencies.

What it means for regular people

This story might not seem very important to most people who only have a little bit of crypto. But it does teach us things. It reminds us that things that sound too good to be true usually are.

It also shows that regulators are getting smarter, which could mean that the rules for taxing, reporting, and controlling cryptocurrency will change.

The UK Bitcoin seizure also shows that people who have been scammed can still take action. You can get better, even if it takes a long time and isn't perfect. People feel better knowing that the law is slowly changing to make the online market safer.

Critics Are Worried

Not everyone is happy. People are worried about what will happen if governments make money from seized cryptocurrencies. Should states keep the money they make if Bitcoin's price goes up? What about the people who got hurt?

Some people are worried about overreach because they think the new powers to take things could be misused. These are good things to say.

The UK taking Bitcoin will face legal challenges, appeals, and political scrutiny. It's a big step forward, but it also shows how far behind systems are when it comes to digital assets.

Last Thoughts

The UK story about the seizure of Bitcoin isn't over yet. There will be legal battles, problems with diplomacy, and changes in the market for a long time. But one thing is clear: the idea that you can't touch digital fortunes is no longer true.

This case is a mix of people being greedy, new technology, and the search for justice that has been going on for a long time. It reminds us that every new idea, no matter how bad, will have to follow the rules at some point.

With a source you can trust:

The Metropolitan Police Research firm's official newsroom says that Chainalysis said in a report from 2025 that "This case shows that blockchain transparency, along with international cooperation, makes large-scale crypto crime more and more risky.

The UK Bitcoin seizure shows how fast criminals exploit digital gaps. Hoplon Infosec’s penetration testing helps uncover system weaknesses before attackers do, keeping organizations secure and resilient.

Share this :