ServiceNow $7 Billion Deal Reported as Stock Falls Sharply

Hoplon InfoSec

16 Dec, 2025

When news broke that ServiceNow might be about to make a big purchase, almost everyone who follows the enterprise software world reacted. People who know about the situation say that ServiceNow is in advanced talks to buy the cybersecurity company Armis for $7 billion.

This would be the biggest purchase the company has ever made, and people are both excited and worried about it. The immediate effect was a big drop in ServiceNow stock as traders and investors reevaluated risk and value. The story is still unfolding, and while many reporters are sure of the basic facts, the companies themselves have not confirmed the deal.

What the ServiceNow $7 Billion Deal Could Mean and How the Talks Went Down

Several news outlets said late on the weekend and early on Monday morning that ServiceNow is in advanced talks to buy the cybersecurity startup Armis for $7 billion. These reports come from unnamed sources who know what's going on and are based on financial news reporting. If it goes through, this would be the biggest deal in the company's history, much bigger than most of the acquisitions ServiceNow has made in the past few years. People say that the talks are going well, but it's still not clear if they will end with a signed agreement.

In the past, Armis was getting ready for an IPO and had been worth more than six billion dollars in previous funding rounds. The business's main focus is helping businesses keep an eye on and protect their connected devices in real time. That includes everything from business laptops to sensors used in factories. ServiceNow's interest in Armis is part of a larger trend of enterprise software companies looking for more cybersecurity experts.

Why This Is a Big Deal for ServiceNow

ServiceNow is now one of the biggest makers of workflow automation software, which is used by thousands of big companies all over the world. It has also put money into AI and automation in the last few years by buying smaller companies and building things in-house.

This is a different kind of ServiceNow Armis acquisition because it would add a lot of cybersecurity tools to the company's portfolio. This could change how customers view the ServiceNow platform, especially those who want more security for their online activities.

Some analysts think this makes sense from a business point of view because the combination of operational software and cybersecurity tools shows that customers want solutions that work together. Some people say that big deals can be bad for business and get in the way of growth. Risk is still very much on the table because the talks could still fall through or change terms.

Why ServiceNow's stock is down today

Investors don't like things that are uncertain very much. When the news about the $7 billion ServiceNow deal hit financial news sites, the market reacted right away. Early in the trading day, the company's stock fell sharply as investors rethought the company's prospects for revenue, growth, and profits. There were a few reasons for this response:

• ServiceNow might have to spend a lot of money or do a lot of complicated integration work if it buys a big company. Some investors are worried that this might slow growth down instead of speeding it up.

• The software industry as a whole has been under a lot of pressure, and big tech companies have been punished in the past for changing their strategies.

• Some analysts also lowered their ratings on the stock around the same time as the rumors, linking the news to worries about future growth in general.

The short answer to your question about why ServiceNow stock dropped today is that a combination of deal uncertainty, perceived risk, and general market sentiment led to selling pressure. Traders often act before official announcements, which makes share prices go up and down quickly when big acquisitions are announced.

How the Armis Acquisition Will Affect ServiceNow Investors

There are a lot of important things to think about when you look more closely at the possible acquisition. Not just the headline, but also the context and history are important here.

First, Armis has a lot of cybersecurity technology and knowledge that ServiceNow doesn't have right now. After a year of major cyberattacks around the world, there is a high demand for security tools that can find and handle risks across connected devices. This could help ServiceNow do better in the business software market.

Second, buying things this big also costs a lot of money. A close look at the value of the ServiceNow Armis deal shows that the price might be justified by Armis's own growth and revenue potential. However, investors are still not sure if this fits with ServiceNow's core strengths. Some people are worried that focusing on scaling up in cybersecurity could take away from ServiceNow's legacy growth engines, such as AI services and workflow automation.

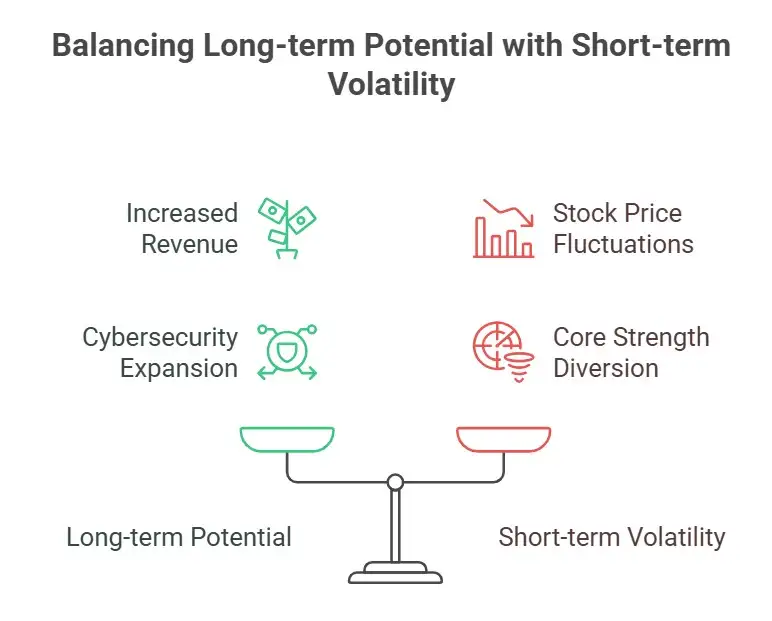

Lastly, when you think about how the Armis acquisition will affect ServiceNow investors, you need to weigh the long-term potential against the short-term volatility. If you do a good job of integrating, it could pay off years down the road by bringing in more money. But the stock market usually pays more attention to short-term signals, which can cause prices to change quickly until things become clearer.

Main Points

The deal has some good points: it adds cybersecurity features to ServiceNow's platform.

• Could help get customers who want all of their operational and security tools in one place.

• Fits in with the trend of buying enterprise software that combines workflow and security.

Cons and Risks

• The acquisition could take attention away from important growth areas and product development that is already in progress.

• Investors didn't like it, which made ServiceNow's stock price drop and put more pressure on the share price.

• The deal is still not set in stone, and it could fall through or change, which means there is still uncertainty.

People Also Want to Know

Why did the price of ServiceNow stock go down after the report?

ServiceNow's stock price went down because big purchases make it hard to predict how much it will cost and how much it will grow in the future. When news broke that Armis might be bought for almost seven billion dollars, investors sold their shares because they were worried about the risks and the distraction from their main business.

What will the purchase of Armis mean for ServiceNow?

If the deal goes through, ServiceNow would get technology and people who are good at monitoring device risk and cybersecurity. This could help it serve customers who want both operational and security tools in one place. But this also means that there will be problems with integration and costs.

Is the deal between ServiceNow and Armis real?

Not yet. There have been reports that the companies are in advanced talks, but neither side has officially confirmed this. That means things could change before the final announcement is made.

When might the deal be made public?

Some people who work for the company think a deal could be announced soon, but there is no set date. Talks that are already advanced can still fall through or be pushed back.

The end and what's next to watch

There has been a lot of talk about ServiceNow's possible $7 billion deal to buy Armis this week in the fields of cybersecurity and business software. This is a moment that shows both the ambition and the risk that come with buying a lot of technology.

ServiceNow's stock price drop shows how sensitive markets are to uncertainty and how important it is for investors to have clear information. In the next few days, keep an eye out for official news from the companies and comments from experts in software and cybersecurity. You will be able to make better decisions if you know both how the deal fits into your overall strategy and the numbers behind it.

You can also read these important cybersecurity news articles on our website.

· Apple Update,

For more, please visit our Homepage and follow us on X (Twitter) and LinkedIn for more cybersecurity news and updates. Stay connected on YouTube, Facebook, and Instagram as well. At Hoplon InfoSec we’re committed to securing your digital world.

Share this :